One of the most pressing concerns for timeshare resorts is – and may continue to be – the increase in insurance premiums that has impacted the industry for the past few years.

But by understanding the factors at play, and by implementing strategies to mitigate risks; timeshares, resorts and destination properties can navigate this storm and ensure a sustainable future.

Premiums Likely to Remain High

A huge factor in the industry's rising premiums is driven by the growing frequency and severity of natural disasters and climate change.

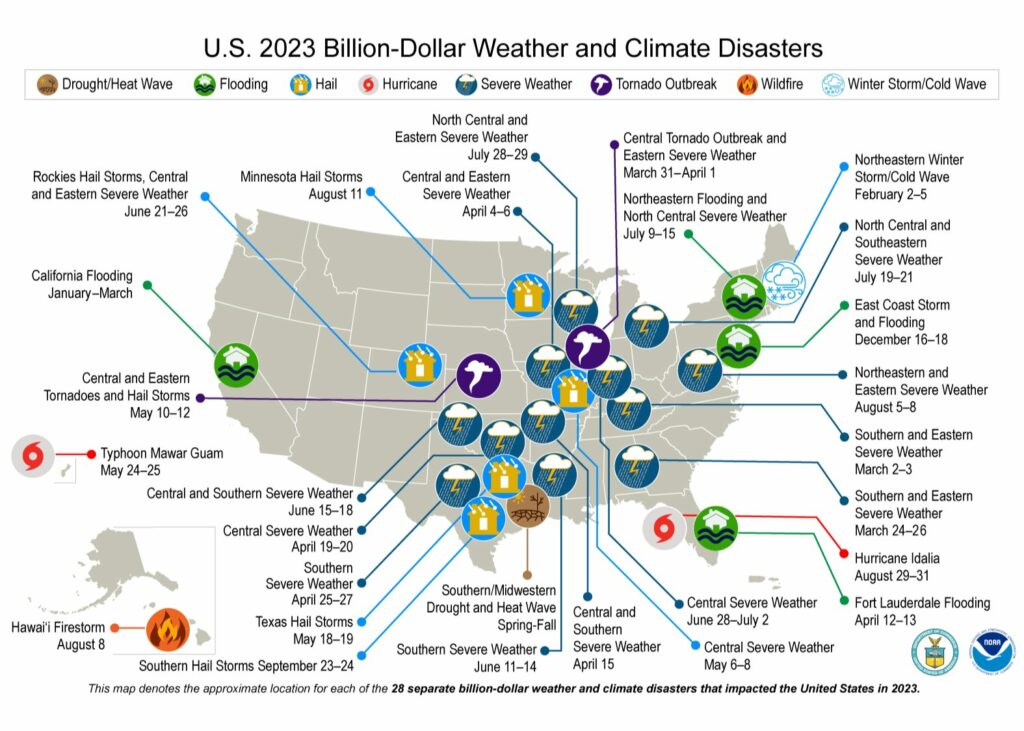

According to the National Oceanic and Atmospheric Administration (NOAA), the United States was struck with a historic number of $1 billion disasters in 2023. A record-breaking total of 28 natural disasters, including severe weather and hail events, flooding, extreme cold, tropical storms, wildfires and more cost a total of over $92.8 billion.

2024 was yet another active year for billion-dollar disasters, with 27 individual weather and climate disasters trailing 2023's record year by just one event. 2024 totaled an estimated cost of $182.7 billion, the fourth-costliest year in history and well exceeding 2023's estimated financial impact.

So What's the Point?

Unfortunately, destination properties like timeshares and vacation rentals located in picturesque areas, often find themselves susceptible to natural disasters including hurricanes, floods and wildfires. These events are becoming more common – and more costly – in recent years.

There's no way to prevent a hurricane, but there are ways to protect your property, and to make a case to underwriters that your risk is one worth insuring. In the Regional Guide to Property Risk, we break down each region of the United States and explain what measures you can take to secure coverage with favorable terms and conditions.

Rise in Extreme Weather Events

Climate change has exacerbated the frequency and intensity of these events. The Intergovernmental Panel on Climate Change (IPCC) has documented a significant rise in extreme weather events over the past few decades, and this trend is expected to continue.

Many destination properties are situated along coastlines, making them particularly vulnerable to hurricanes and sea-level rise. Additionally, the devastating wildfires in California and Hawaii in recent years serve as stark reminders of the risks posed by a changing climate.

Several factors are converging to create what can only be described as a perfect storm for the timeshare industry. These include:

Natural Disasters

Recent Atlantic hurricane seasons have been among the most active on record, and the NOAA predicts above-normal hurricane activity in the Atlantic basin in 2024. Extreme weather is having an impact all over the world.

Inland locations pose their own challenges, including wildfires, droughts and inland flooding. The escalating costs associated with rebuilding and repairing properties are inevitably passed on to the consumer through higher insurance premiums. Midway through 2023, the U.S. has experienced nine confirmed weather/climate disaster events – wildfires and tornadoes — with losses exceeding the $1 billion mark.

Regulatory Changes

Governments and regulatory bodies are tightening their grip on the insurance industry. Stricter building codes aimed at mitigating the effects of natural disasters, and increased capital requirements for insurers, are driving up costs. These regulatory changes are translating into higher premiums for timeshare owners.

Market Dynamics

The insurance market is cyclical, and we are currently in a hard market phase. This means that insurers are becoming more selective in underwriting risks and are charging higher premiums. The timeshare industry, with its unique set of risks, is feeling the pinch as insurers seek to balance their portfolios. A quick glance at the underwriting statistics from 2023 will show that the U.S. property and casualty insurance industry reported a total of $21.2 billion in underwriting losses, continuing a trend after $26.5 billion in losses in 2022 and $21.5 billion in 2021.

Reinsurance Costs

To spread the risk, insurers often purchase reinsurance. However, as natural disasters become more common, the cost of reinsurance also rises, and this cost is passed on to policyholders in the form of higher premiums. The cost of reinsurance is impacted by many factors, and is among our top trends to watch in 2024 and beyond.

Technological Risks

As timeshare resorts embrace technology to enhance customer experiences, they also expose themselves to cyber risks. Data breaches and cyber attacks can result in significant financial losses and reputational damage. Insurers are factoring in these risks, and again, this is reflected in the premiums.

How Destination Properties Can Navigate the Insurance Market

For timeshare resorts, rising insurance premiums are a bitter pill to swallow. However, the news isn't all bad – in fact, we've had success with several destination property clients who have actually seen their premiums go down. These strategies can be employed to mitigate the impact:

Risk Management

Implementing robust risk management practices is essential. They include ensuring that properties are built to withstand natural disasters, employing cybersecurity measures and training staff to deal effectively with emergencies.

In the video below, see how our team of advisors specializing in resorts, timeshares and destination properties leverages their knowledge to understand your unique needs and requirements.

Diversification

If possible, developers should consider diversifying the locations of their timeshare properties to spread the risk. Not only can this help mitigate the risk of a single storm or catastrophic event impacting multiple properties, it also empowers timeshare management companies to potentially negotiate better terms with insurers.

Engaging with Insurers

Timeshare resort boards of directors and managers should actively engage with insurers to understand how they evaluate risks related to natural disasters and climate change. By demonstrating a commitment to resilience and effective risk management, resorts may have the opportunity to negotiate more favorable insurance terms.

Final Thoughts

The timeshare industry is sailing into choppy waters with the expected rise in insurance premiums in 2025 and beyond. However, by understanding the factors at play and implementing strategies to mitigate risks, timeshare resorts can navigate this storm and ensure a sustainable future. In these uncertain times, we cannot stress enough the importance of proactive measures.

Learn More About Risk Management for Destination Properties

Don’t miss the other entries in this series:

How Timeshare Associations Can Navigate Increasing Premiums

How HOAs and Management Companies Can Optimize the Insurance Bidding Process

Is the Timeshare Insurance Market Softening?

Why Your HOA Board Needs Strategic Partnerships

This content is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel or an insurance professional for appropriate advice. Gregory & Appel is neither a law firm nor a tax advisor; information in all Gregory & Appel materials is meant to be informational and does not constitute legal or tax advice.

This content originally appeared in TimeSharing Today in November 2023.