An analysis of 2025 early indicators, affirmed what industry experts have been signaling: the commercial property insurance market is indeed softening.

Two compelling examples are from Florida, a state that has been hit the hardest in recent years, as property carriers have been pulling out of the state, while others have been reducing available capacity and/or charging exorbitantly higher premiums:

- A large property consisting of seventeen buildings, all with frame construction, reported an 11% reduction year-over-year in premiums

- A group of six coastal properties, primarily featuring frame construction, reported a 1% reduction year-over-year in premiums

We have seen that this trend is not isolated – similar patterns are emerging across the industry – indicating a broader market movement. Evidence of this can be seen in a recent win in Nevada, where a large, multi-state property management company renewed its insurance policy flat after two years of rate increases.

This trend comes as a welcomed sign of relief for all after experiencing rate increases for the past four to five years, specifically, absorbing brutal three-digit rate increases, respectively, in the last two years.

Key Factors Influencing the Market

Several pivotal factors are driving this shift towards a softer market, each playing a critical role in reshaping the landscape of commercial property insurance:

- Entry of new carriers: The introduction of new insurance carriers into the market injects fresh competition, compelling established players to reassess their pricing strategies to retain and attract clients.

- Increased capacity: A surge in underwriting capacity, fueled by both existing insurers and newcomers, allows for more aggressive pricing and policy terms, benefiting policyholders.

- Changing carrier appetite: Insurers are diversifying their portfolios, showing an increased willingness to cover different types of risks, including previously underinsured segments.

- Organized reinsurance renewal season: This year’s reinsurance renewals have been notably more structured, contributing to retention stability and rate leveling. This is the result of enhanced profitability among reinsurers, as well as an uptick in their capital positions, enabling more competitive reinsurance rates for primary carriers.

- Alignment of property valuations: Current valuations are increasingly reflecting today’s construction costs, aiding in the accurate pricing of risks and contributing to market equilibrium.

Taking Advantage of Trends

These key factors are having an impact on the insurance industry, which can have a significant impact on your risk management program. In the video below, see how Gregory & Appel's expert risk advisors are uniquely suited to represent you in the marketplace. Their creativity in creating coverages to help you manage risks is vital – and they can help secure the right coverage for your unique needs.

Who Stands to Benefit?

In this evolving market, certain properties are poised to see better-than-normal returns:

- Non-catastrophe (Non-CAT) properties: Locations outside high-risk zones for natural disasters can expect more favorable terms.

- Higher-rated construction: Properties built with fire-resistant materials as opposed to frame construction are deemed a lower risk, attracting better rates.

- Low-loss properties: Buildings with minimal or no claims history are likely to be rewarded with lower premiums.

- Corrected valuation properties: Those that have addressed and overcame previous undervaluation issues stand to benefit from more accurate and potentially favorable insurance terms.

- Industry class considerations: The nature of your business and the associated risk profile could also influence the insurance terms and rates you receive.

Trends to Watch

As the market continues to adjust, timeshare HOAs and property managers should keep a close eye on several key areas:

Ongoing Reinsurance Renewals

The outcomes of recent and upcoming treaty renewals will be critical in determining if the early trend towards a softer market holds. As these are renewed or renegotiated, we'll see trends in the availability of reinsurance and pricing adjustments.

What is Reinsurance?

In simple terms, reinsurance is a way for insurance companies to protect themselves from large financial losses. When an insurance company sells policies to individuals or businesses, it takes on the risk of having to pay out claims if certain events occur, such as accidents, disasters, or other covered incidents.

Reinsurance is like insurance for insurance companies. Instead of shouldering all the risk themselves, insurance companies can transfer some of that risk to other companies known as reinsurers.

In exchange for a premium, the reinsurer agrees to share in the financial responsibility of paying claims. This helps the original insurance company manage its exposure to large losses and ensures that it has the financial capacity to fulfill its obligations to policyholders.

A Look Inside the Reinsurance Market

Positive trends kept pace on 4/1 as foreign markets mimicked the January 1 reinsurance renewals in the U.S. Japan saw pricing flat to slightly down, while South Korea, China and India saw increased competition for catastrophe business.

What It Means

Optimism is growing heading into midyear that reinsurers are exhibiting a returning appetite for property catastrophe business, which signals an increasing return to a softer market.

Catastrophic Events

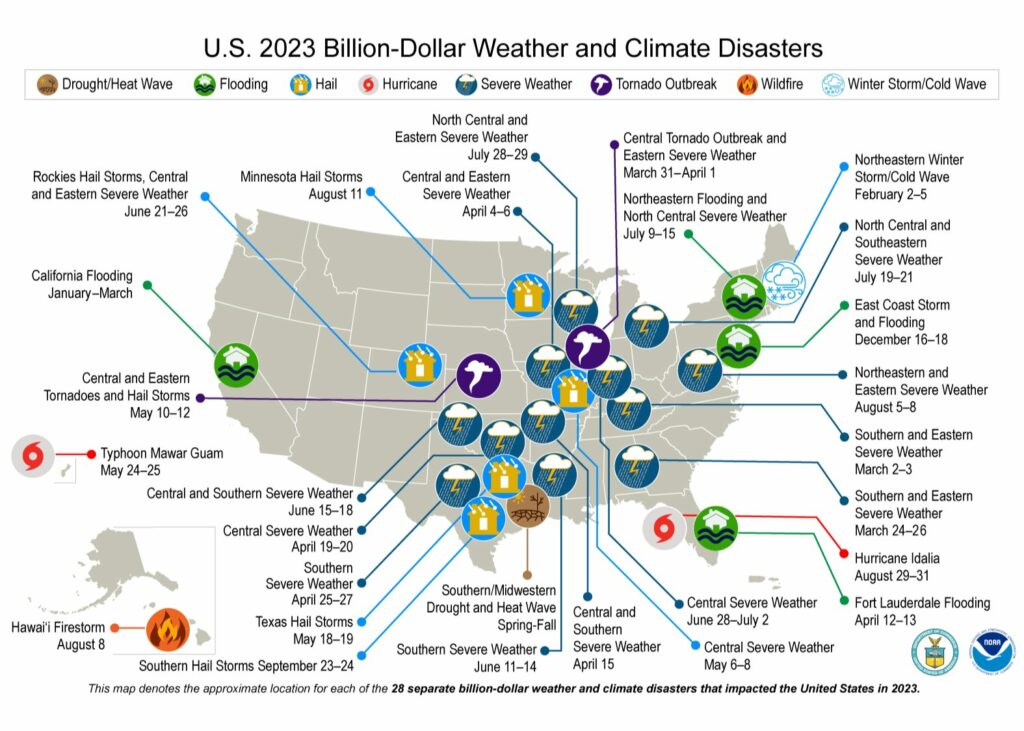

One reason why commercial property insurance premiums are so high for destination properties is the high occurrence of natural disasters and catastrophic weather events. Despite 2023 witnessing 28 catastrophic events with losses exceeding $1 billion each, only one of these events was a hurricane.

The 28 billion-dollar disaster events events from 2023 include:

- 1 winter storm event

- 1 wildfire event

- 1 drought and heat wave event

- 4 flooding events

- 2 tornado events

- 2 tropical storms

- 17 severe weather/hail events

Severe Convective Storms

These storms, characterized by tornadoes, hail and severe wind, contributed to over $50 billion in losses in 2023. Their frequency and impact remain a significant concern.

Wildfires and Other Risks

The scale of wildfire damage, alongside potential political and socio-economic shifts, will influence the market’s trajectory.

Planning Takeaways

As the commercial property insurance market softens, it presents both opportunities and challenges. By understanding the drivers behind this trend and staying alert to ongoing changes, insureds and insurance professionals can navigate the market more effectively, securing favorable terms while adequately protecting an insured’s assets.

As 2024 unfolds, adapting to these dynamics will be key to leveraging the softening market to your advantage.

Learn More About Risk Management for Destination Properties

Don’t miss the other entries in this series:

Why Are Insurance Premiums for Timeshares So High?

How Timeshare Associations Can Navigate Increasing Premiums

How HOAs and Management Companies Can Optimize the Insurance Bidding Process

Why Your HOA Board Needs Strategic Partnerships

This content is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel or an insurance professional for appropriate advice. Gregory & Appel is neither a law firm nor a tax advisor; information in all Gregory & Appel materials is meant to be informational and does not constitute legal or tax advice.

This content originally appeared in TimeSharing Today in May 2024.