If your organization has a good loss history, a group captive could help you save money while providing access to industry-leading loss control resources.

Think your business may be a fit? Connect with us below to get started with a review of some basic information.

Our program represents one of the highest return to member advantages of any AD partnership. Know you're maximizing every dollar you spend.

Unlike firms who answer to private equity & external stakeholders, we make the decision that's right for our clients. Every time.

Brad Dumbauld has decades of experience supporting distributors just like you.

He'll give you an idea of whether a group captive could be a good fit for you – based on how much you've paid in premiums and your loss history over the past five years.

Most of our clients experience lower costs within 3-5 years. In our experience, once a new member joins, they never consider leaving.

Instead of market fluctuations and rising costs you can't control, you'll join a smaller risk pool with other safety-minded organizations.

Gain direct access to risk control resources and services, as well as a network of peers who are incentivized to minimize claims.

In the group captives we work with, premium dollars are invested and members often experience a significant return over time.

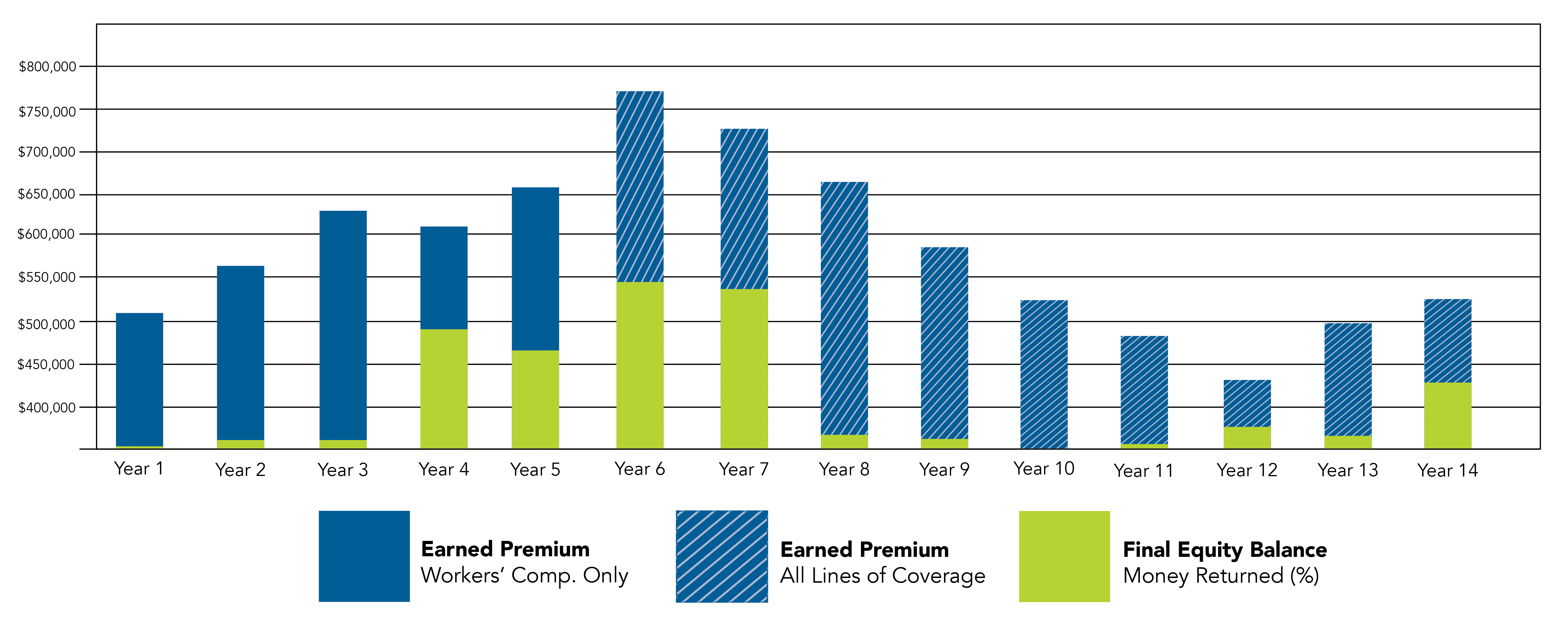

Since joining a group captive, this Gregory & Appel client doubled their revenue and exposures due to growth, yet they've paid half as much for significantly more coverage, while also earning money back.

In this comprehensive guide, learn about the different types of captives, the benefits of captive insurance, and more.

Read MoreLearn about group captives, its benefits over traditional insurance and what types of businesses should consider alternative risk.

Read MoreHere we define risk retention groups and explain how they are different from traditional insurance and captive insurance.

Read More